What is IRFC IPO?, Is it good to invest in Irctc IPO? IRFC IPO | IRFC IPO Date 2021

Indian Railway Finance Corporation (IRFC) initial public offer (IPO) is planned to open on 18th January for pubic subscription and close on 20th January 2021 and set the value band at Rs 25-26 per share.

The shares of IRFC are proposed to be listed on BSE and NSE. The company aims to raise a total of Rs. 4,633.38 Crores approximately, fresh issue – Rs 3,089 Crores, OFS – Rs 1,544 Crores4,633.4.

What is IRFC?

Indian Railways Finance Corporation is a Government-owned NBFC (Non-Banking Financial Institution). This means IRFC is to raise money

and asset for Indian Railways. IRFC provides funds If the Ministry of railways needs

funds for railways infrastructure development, coaches, a new project, or existing

projects.

IRFC IPO Details

|

IRFC IPO – Issue Details |

|

|

IRFC IPO Date |

Jan 18 to Jan 20, 2021 |

|

Face Value |

Rs 10 per share |

|

IPO Price band |

Rs 25 to Rs 26 per share |

|

Issue Size |

Total of Rs 4,633.38 Crores (approx) Fresh issue – Rs 3,089 Crores OFS – Rs 1,544 Crores |

|

IPO Lot Size |

575 shares |

|

Lead Managers |

IDFC Securities, HSBC Securities, ICICI

Securities and SBI Capital Markets |

|

Listing at |

BSE and NSE |

IRFC IPO Objective

This is a very important segment for investors who wants to invest for the long term read all details

- Offer For Sale (OFS): 59.4 Crore Shares. The amount of money raised through offers for sale will go to the entire shareholders of the Indian government. And The Company will not get any money.

- Fresh Issue 178.2 Crore: The Money raised through the fresh issue will be an investment in the company’s business growth and to meet capital requirements. How this money exactly will be used for IRFC for that you have to understand the IRFC future roadmap.

IRFC IPO Strengths

- If India is to bring growth in railways so the Government will have to rely on IRFC. This is a very strong strength for the company. Because the Government of India is Dependent on IRFC performance

- Sound asset-liability management: The money borrow model of IRFC is also good and matches with industry rates. The asset-liability management of IRFC is quite good.

- Sound credit rating: Good credit rating i.e. CRISIL AAA/A1+ and ICRA AAA/A1+.

- Strong financial performance: IRFC’s financial performance has been consistently good it followed a cost-plus model. So everything is positive about IRCF, then what is the concern about subscribing to IRFC IPO?

- Experienced management and Strategic role in Indian Railways growth

- But some important points for those who are thinking of long term investment before subscribing!

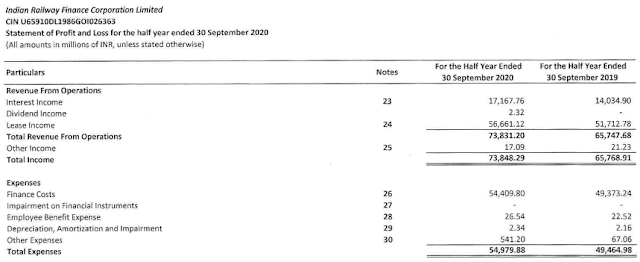

Financial Statement of IRFC

IRFC IPO Weakness

- The Indian Government has a target of disinvestment of 2.1 Trillion in 2021. Through this IRFC IPO, 14% of shares of IRFC are being sold and about 4600 Crore being raise.

- But similarly, if the government privatized the Indian railway, some rail routes in South India have been given to already private players. If the Indian railways take out alternative routes to raised funds, so there can be a lot of impact on the demand and business of IRFC.

- And then as the other PSU Bank is being merged, similarly there can happen with IRFC as well with some private NBFC.

- At the moment, IRFC’s profit margins have been good. IRFC’s upper price band is 26 and EPS 3.6X and P/E ratio 7.2X in FY 20.

- At the moment IRFC does not have any peers in the market so there cannot be a direct comparison. But price band in 26 and P/E ratio 7.2x is considered a good marker.

- No doubt to Subscribe to IRFC IPO but long-term investors must think twice before investing as per their long term strategy. Because there is stated in financial planner IRFC has to grow business. On the other hand, privatization of the railways is under heavy noise.

- There have also been many fast railways corridor bans in India. But in all these foreign investments are coming from outside. This is the tension for long term investment that IRFC should not lose its relevance and go into the hands of private players.

How to Apply for Burger King IPO?

- Initial Public Offer (IPO) is one of the ways to buy shares of the company going to the public.

- If you are interested and wants to apply for IRFC IPO, the go with complete detail of company and IPO to make the right decision.

- To apply for an IPO you can use your saving to invest or you can borrow money from banks and other non-financial companies.

- The next important thing that is essential to apply for an IPO is to have a Demat Account.

- Having a Demat Account with Angel Broking, know how to apply for IPO in Angel Broking?

- Other than this, you will able to apply for IPO through UPI. download any UPI apps and apply them without any difficulty.

- You can open a Demat account by submitting you PAN Card, Adhar Card, and Bank Details with any of the stockbroker like Angel Broking.

0 Comments